UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registranto¨

Check the appropriate box:

| Preliminary Proxy Statement |

| Confidential For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

SANTA FE FINANCIAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. |

Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration No: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

santa fe financial corporation

10940 Wilshire Blvd., Suite 2150

los angeles, California 90024

(310) 889-2500

Notice of annual meeting of shareholders

to be held on february 20, 2014

MARCH 3, 2017

To the Shareholders of Santa Fe Financial Corporation:

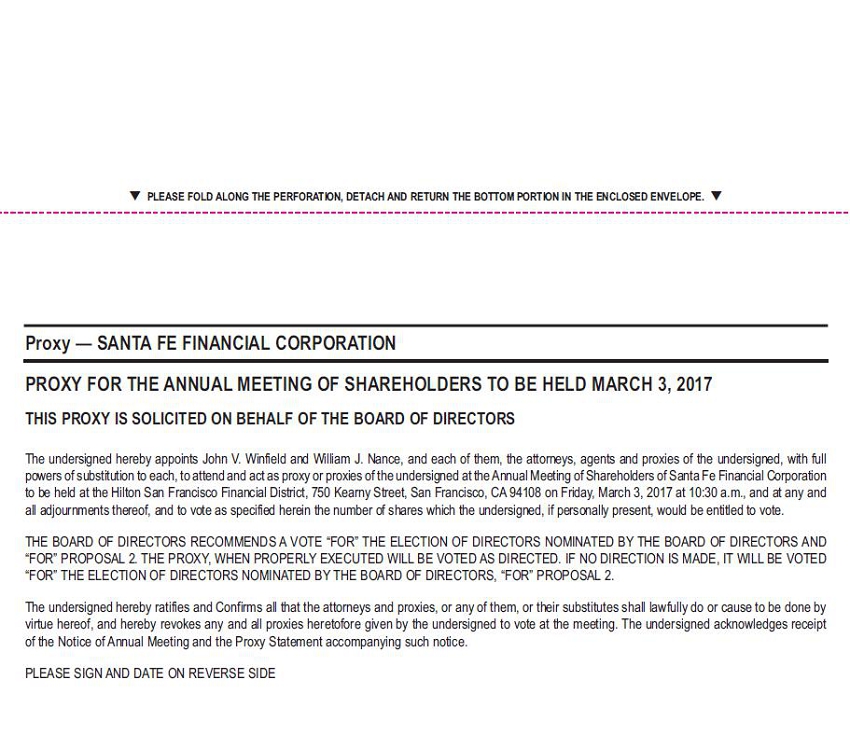

NOTICE IS HEREBY GIVEN that the fiscal 2016 Annual Meeting of Shareholders of Santa Fe Financial Corporation (“Santa Fe” or the “Company”) will be held on February 20, 2014March 3, 2017 at 11:0010:30 A.M. at the Hilton San Francisco Financial District, 750 Kearny Street, San Francisco, CA 94108 for the purpose of considering and acting on the following:

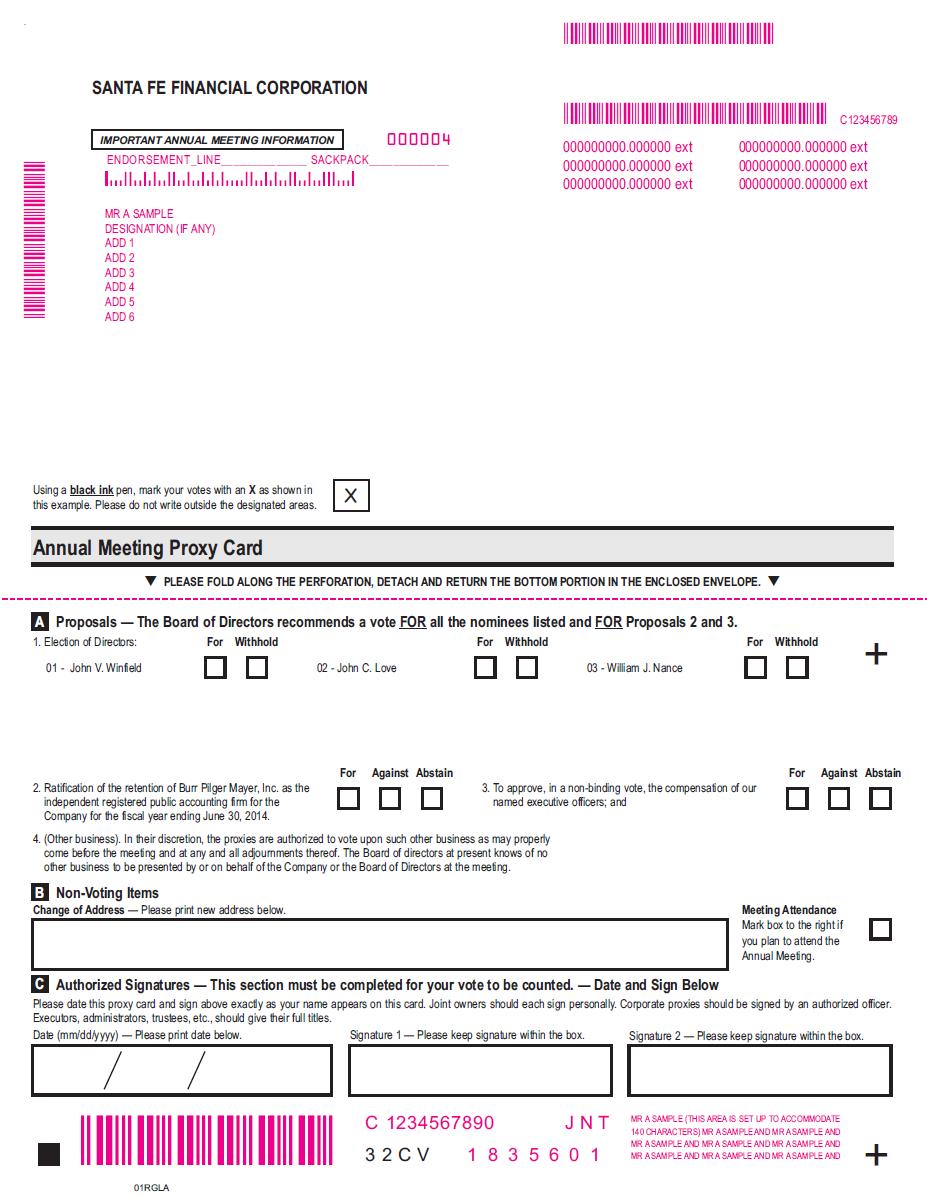

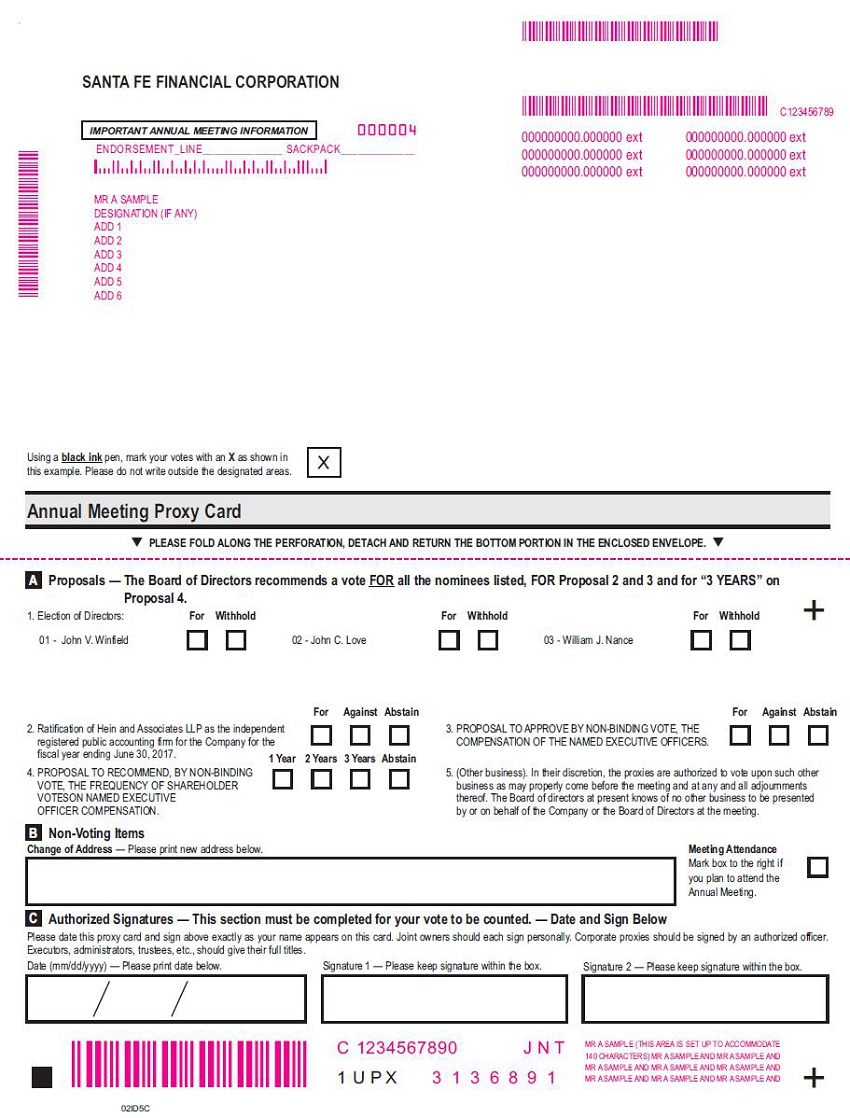

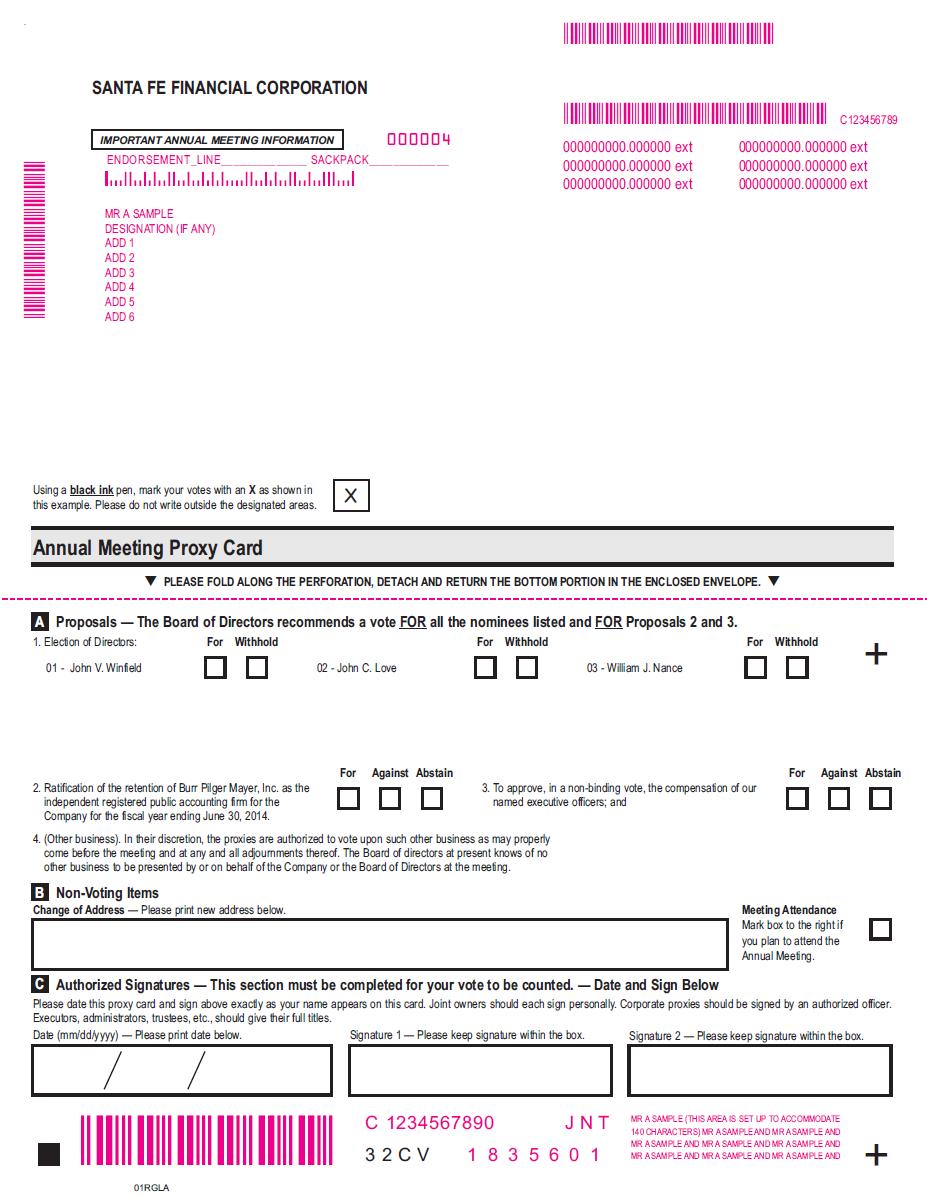

| (1) | To elect three Directors to serve until the next Annual Meeting or until their successors shall have been duly elected and qualified; |

| (2) | To ratify |

| (3) | To approve, in a non-binding vote, the compensation of our named executive officers; |

| (4) | To determine, in a non-binding vote, whether a shareholder vote to approve the compensation of our named executive officers should occur every one, two or three years; and |

| To transact such other business as may properly come before the |

The Board of Directors has fixed the close of business on January 13, 20142017 as the record date for determining the shareholders having the right to vote at the meetingAnnual Meeting or any adjournment thereof.

Your proxyvote is important to us whether you own a few or many shares. Please complete, sign, date and promptly return the enclosed proxy in the self-addressed, postage-paidpostage pre-paid envelope provided. Return the proxy even if you plan to attend the meeting.Annual Meeting. You may always revoke your proxy and vote in person.

| By Order of the Board of Directors, | |

| January 27, 2017 | /s/ Clyde W. Tinnen |

| Acting Secretary |

January 27, 2014

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on February 20, 2014. The Company’s Proxy, Proxy Statement and Annual Report on Form 10-K for the fiscal year ended June 30, 2013 are also available on the Santa Fe page of its parent company’s website at:www.intgla.com

SANTA FE FINANCIAL CORPORATION

10940 Wilshire Blvd., Suite 2150

los angeles, California 90024

(310) 889-2500

PROXY STATEMENT

annual meeting of shareholders

to be held on february 20, 2014

MARCH 3, 2017

The Board of Directors of Santa Fe Financial Corporation (the “Company” or “Santa Fe”) is soliciting proxies in the form enclosed with this proxy statement in connection with the fiscal 2016 Annual Meeting of Shareholders (the "Annual Meeting") to be held February 20, 2014March 3, 2017 or at any adjournment or adjournments thereof.

This Proxy Statementproxy statement and the accompanying Proxyproxy card are first being sent to Shareholdersshareholders on or about January 27, 2014.2017. Only shareholders of record at the close of business on January 13, 20142017 are entitled to notice of, and to vote at, the Annual Meeting.

If you give us a proxy, you can revoke it at any time before it is used. To revoke it, you may file a written notice revoking it with the Secretary of the Company, execute a proxy with a later date or attend the meetingAnnual Meeting and vote in person.

You may vote at the Annual Meeting only shares of the Company's common stock, $.10 par value per share (the "Common Stock"), that you owned of record on January 13, 2014.2017. There were 1,241,810 shares of common stockCommon Stock outstanding on that date. A majority, or 620,906 shares will constitute a quorum for the transaction of business at this meeting.the Annual Meeting. Each share is entitled to one vote on each matter to be presented at the meeting.Annual Meeting. The affirmative vote of the holders of the majority of the shares of the Company’s stock present or represented at the meetingAnnual Meeting and entitled to vote is required to elect directors, to ratify the selection of the Company's independent registered public accounting firm, to approve the non-binding resolution on the compensation of our named executive officers, and ratify or approve the other proposals being voted on at this time. The non-binding advisory vote as to the frequency (every one, two or three years) with which the non-binding shareholder vote regarding the approval of the compensation of our named executive officers should be conducted will require you to choose between a frequency of every one, two or three years or to abstain from voting on that proposal. Note that shareholders are not voting to approve or disapprove the recommendation of the Board of Directors with respect to this proposal. Because your vote is advisory, it will not be binding on us or the Board of Directors. However, the Board of Directors will review the voting results and take them into consideration when making future decisions regarding the frequency of the advisory vote on executive compensation.

The proxies named in the accompanying proxy card will vote the shares represented thereby if the proxy appears to be valid on its face, and where specification is indicated as provided in such proxy, the shares represented will be voted in accordance with such specification. If no specification is made, the shares represented by the proxies will be voted: (1) FOR the election the directors to serve until the next Annual Meeting; (2) FOR ratification of the appointment of Hein and Associates LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2017; (3) FOR approval of the compensation of executive officers; and (4) FOR 3 Years as the period of time that non-binding shareholder votes should occur to approve compensation of executive officers.

In addition to mailing this material to shareholders, the Company has asked banks and brokers to forward copies to persons for whom they hold stock of the CompanyCommon Stock and to request authority for the execution of proxies. The Company will reimburse banks and brokers for their reasonable out-of-pocket expenses in doing so. Officers of the Company may, without being additionally compensated, solicit proxies by mail, telephone, telegram or personal contact. All proxy soliciting expenses totaling approximately $3,000 will be paid by the Company. The Company does not expect to employ anyone else to assist in the solicitation of proxies.

1

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company's bylaws set the number of directors at three. We propose to elect three directors, each to hold office until the next Annual Meeting of Shareholders and until his or her successor is elected and qualified. The Board of Directors has nominated John V. Winfield, John C. Love and William J. Nance. The persons named in the enclosed form of proxy card will vote for the election of the nominees listed below unless you instruct otherwise, or a nominee is unable or unwilling to serve. The Board of Directors has no reason to believe that any nominee will be unavailable. However, in that event, the proxy may vote for another candidate or candidates nominated by the Board of Directors. Any shareholder executing the enclosed form of proxy card may withhold authority to vote for any one or more nominee by so indicating in the manner described in the form of proxy.proxy card.

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information with respect to the Directorsdirectors, executive officers and Executive Officerssecretary of the Company. There is no relationship by blood, marriage or adoption among the Directorsdirectors and Officers.officers. All Directorsdirectors serve one year terms with their terms expiring at the Annual Meeting. All Officersofficers of the Company are elected or appointed by the Board of Directors and hold office until the Annual Meeting or until replaced at the discretion of the Board.

| Name | Age | Position with the Company | Director Since | Shares of Common Stock Beneficially Owned on January 13, 2014 | Percent of Class(1) | |||||||||

| John V. Winfield(2) | 67 | Chairman, President and Chief Executive Officer | 1995 | 1,049,627 | (2) | 84.5 | % | |||||||

| William J. Nance | 70 | Director | 1996 | 0 | (3) | 0.0 | % | |||||||

| John C. Love | 73 | Director | 1998 | 0 | (3) | 0.0 | % | |||||||

| Michael G. Zybala | 61 | Vice President, Secretary and General Counsel | N/A | 0 | 0.0 | % | ||||||||

| David T. Nguyen | 40 | Treasurer and Controller | N/A | 0 | ||||||||||

| All of the above as a group | 1,049,627 | 84.5 | % | |||||||||||

__________________

(1) Based on 1,241,810 shares of common stock issued and outstanding as of January 13, 2014.

(2) John V. Winfield is the sole beneficial owner of 49,400 shares of common stock. The InterGroup Corporation ("InterGroup") is the beneficial owner of 1,000,227 shares of common stock. As the President, Chairman of the Board and a 626% shareholder of InterGroup, Mr. Winfield has voting and dispositive power with respect to the shares of Santa Fe owned of record and beneficially by InterGroup.

(3) William J. Nance is a 2.4% beneficial shareholder of InterGroup as well as a Director thereof. John C. Love is also a Director of InterGroup and a 0.9% beneficial shareholder of InterGroup.

Name | Age | Position with the Company | Director Since | |||

| John V. Winfield(2) | 69 | Chairman, President and Chief Executive Officer | 1995 | |||

| William J. Nance | 72 | Director | 1996 | |||

| John C. Love | 76 | Director | 1998 | |||

| Clyde W. Tinnen | 44 | Acting Secretary | N/A | |||

| David T. Nguyen | 43 | Treasurer and Controller | N/A | |||

| All of the above as a group |

Security Ownership of Management in Subsidiary

As of January 13, 2014,2017, Santa Fe was the record and beneficial owner of 505,437 shares of the common stock of Portsmouth Square, Inc. (“Portsmouth”) and Santa Fe’s parent company, InterGroup was the record owner of 94,86297,962 shares of Portsmouth, representing approximately 81.8%82.2% of the outstanding common sharesstock of Portsmouth. TheMr. Winfield, the President and Chairman of the Board of Santa Fe and InterGroup, has voting power with respect to common sharesstock of Portsmouth owned by Santa Fe and InterGroup. No other director or executive officer of Santa Fe has a beneficial interest in Portsmouth's shares.

Business Experience:

The principal occupation and business experience during the last five years for each of the Directors and Executive Officers of the Company are as follows:

John V. Winfield --— Mr. Winfield was first elected to the Board in May of 1995 and currently serves as the Company's Chairman of the Board, President and Chief Executive Officer, having been appointed as such in April 1996. Mr. Winfield is also the Chairman of the Board, President and Chief Executive Officer of the Company's subsidiary, Portsmouth, having held those positions since May of 1996. Mr. Winfield is Chairman of the Board, President and Chief Executive Officer of The InterGroup Corporation (“InterGroup”), a public company, and has held those positions since 1987. Mr. Winfield also servesserved as Chairman of the Board of Comstock Mining Inc. (NYSE MKT: LODE) ("Comstock"), a public company, in which he was elected a Director onfrom June 23, 2011.2011 to September 2015. Mr. Winfield’s extensive experience as an entrepreneur and investor, as well as his managerial and leadership experience from serving as a chief executive officer and director of public companies, led to the Board’s conclusion that he should serve as a director of the Company.

2

John C. Love --—Mr. Love was appointed a Director of the Company on March 5, 1998. Mr. Love is an international hospitality and tourism consultant. He is a retired partner in the national CPA and consulting firm of Pannell Kerr Forster and, for the last 30 years, a lecturer in hospitality industry management control systems and competition & strategy at Golden Gate University and San Francisco State University. He is Chairman Emeritus of the Board of Trustees of Golden Gate University and the Executive Secretary of the Hotel and Restaurant Foundation. Mr. Love is also a Directordirector of Portsmouth, having first been appointed in March 1998 and a Directordirector of InterGroup, having first been appointed in January 1998. Mr. Love’s extensive experience as a CPA and in the hospitality industry, including teaching at the university level for the last 30 years in management control systems, and his knowledge and understanding of finance and financial reporting, led to the Board’s conclusion that he should serve as a director of the Company.

William J. Nance --—Mr. Nance was first elected to the Board in May of 1996. Mr. Nance is also a director of Portsmouth. Mr. Nance is the President and CEOChief Executive Officer of Century Plaza Printers, Inc., a company he founded in 1979. He has also served as a consultant in the acquisition and disposition of multi-family and commercial real estate. Mr. Nance is a Certified Public Accountant ("CPA") and, from 1970 to 1976, was employed by Kenneth Leventhal & Company where he was a Senior Accountant specializing in the area of REITS and restructuring of real estate companies, mergers and acquisitions, and all phases of real estate development and financing. Mr. Nance is also Director of InterGroup, and has held such position since 1984. Mr. Nance also serves as a director of Comstock Mining, Inc.Comstock. Mr. Nance’s extensive experience as a CPA and in numerous phases of the real estate industry, his business and management experience gained in running his own businesses, his service as a director and audit committee member for other public companies and his knowledge and understanding of finance and financial reporting, led to the Board’s conclusion that he should serve as a director of the Company.

Michael G. Zybala --Clyde W. Tinnen – Mr. ZybalaTinnen was appointed as Vice President and Secretary of the Company on February 20, 1998. He is also Vice President, Secretary and General Counsel of Portsmouth.December 14, 2014. Mr. Zybala is an attorney at law and has served as the Company's General Counsel since 1995 and has represented the Company as its corporate counsel since 1978. Mr. ZybalaTinnen also serves as Assistant Secretary and counsel toof InterGroup and has heldSanta Fe, having been appointed to those positions on December 14, 2014. Mr. Tinnen is a corporate partner at the law firm of Wither Bergman LLP, where he has been employed since April 2015. Prior to that, Mr. Tinnen served as a corporate partner at the law firm of Kelley Drye & Warren LLP, where he was been employed from January 1999.2010 to March 2015 and as a corporate associate with the law firm of Cravath, Swaine & Moore LLP, where he was employed from September 2006 to December 2009.

David T. Nguyen –Mr. Nguyen was appointed as Treasurer of the Company on February 27, 2003. Mr. Nguyen also serves as Treasurer of InterGroup and Portsmouth, having been appointed to those positions on February 26, 2003 and February 27, 2003, respectively. Mr. Nguyen is a Certified Public AccountantCPA and, from 1995 to 1999, was employed by PricewaterhouseCoopers LLP where he was a Senior Accountant specializing in real estate. Mr. Nguyen has also served as the Company's Controller from 1999 to December 2001 and from December 2002 to present.

Family Relationships: There are no family relationships among directors, executive officers, or persons nominated or chosen by the Company to become directors or executive officers.

Involvement in Certain Legal Proceedings: No director or executive officer, or person nominated or chosen to become a director or executive officer, was involved in any legal proceeding requiring disclosure.

BOARD AND COMMITTEE INFORMATION

Board of Directors:

Santa Fe is an unlisted company and a Smaller Reporting Companysmaller reporting company under rules and regulations of the Securities and Exchange Commission (“SEC”). The majority of its Board of Directors consists of “independent” directors as independence is defined by the applicable rules and regulations of the SEC. The Board of Directors held four meetings during the 20132016 Fiscal Year (in person, telephonically or by written consent). No Director attended (whether in person, telephonically, or by written consent) less than 75% of all meetings held during the period of time he or she served as Director during the 20132016 Fiscal Year.

3

Board Leadership Structure

The Chairman of the Board, Mr. Winfield, also serves as our Chief Executive Officer. The Board believes that combining the Chairman and Chief Executive officer roles is the most appropriate structure for the Company at this time because (i) this structure has had a longstanding history with the Company, which the Board believes has served our stockholders well through many economic cycles and business challenges; (ii) the Board believes Mr. Winfield’s unique business experience and history with the Company makes it appropriate for him to serve in both capacities; and (iii) the Board believes its corporate government processes and committee structures preserve Board independence by insuring independent discussions among directors and independent evaluation of, and communications with, members of senior management such that separation of the Chairman and Chief Executive Officer roles is unnecessary at this time.

The Board of Directors has not established a formal process for security holders to send communications to the Board of Directors and the Board has not deemed it necessary to establish such a procedure at this time. Historically, almost all communications that the Company receives from security holders are administrative in nature and are not directed to the Board of Directors. If the Company should receive a security holder communication directed to the Board of Directors, or to an individual director, said communication will be relayed to the Board of Directors or the individual director as the case may be.

The Company does not have any formal policy with regard to board members attendance at annual meetings of shareholders but encourages each director to attend said meetings. All of the Company’s directors attended the fiscal 20122014 annual meeting of shareholders.

Committees:

Santa Fe has established two standing committees, a Securities Investment Committee and an Audit Committee. The Company does not have any standing nominating or compensation committees of the Board of Directors. Executive compensation is determined by the independent members of the Board. New director nominations, if any, will be considered and determined by the Board of Directors. The Company has no policy with regard to consideration of any director candidates recommended by security holders. As a small business issuer that has approximately 84%85% of its voting securities controlled by one shareholder, the Company has not deemed it appropriate to institute such a policy.

Audit Committee. Santa Fe is an unlisted company and Smaller Reporting Companysmaller reporting company under SEC rules. The Company’s Audit Committee is currently comprised of Messrs.members Nance (Chairperson) and Love, each of whom are independent directors as independence is defined by the applicable rules and regulations of the SEC and NASDAQ, and as may be modified or supplemented. Each of these directors also meets the audit committee financial expert test based on their qualifications and business experience discussed above. The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing: the financial reports provided by the Company to any governmental body or the public; the Company’s system of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established; and the Company’s auditing, accounting and financial processes generally. The Audit Committee is responsible for the selection and retention of the Company’s independent registered public accounting firm. The Audit Committee held sixfour meetings during the 20132016 fiscal year.

The Company’s Board of Directors has adopted a written charter for the Audit Committee, a copy of that written charter, as amended, is posted on the Santa Fe page of its parent company’sthe InterGroup website www.intgla.com.

Securities Investment Committee. On March 17, 1998, the Company established a Securities Investment Committee to establish guidelines and to review the Company’s investment policies. The Committee consists of all the members of the Board, with Mr. Winfield serving as Chairperson. During fiscal 2013,2016, the Securities Investment Committee held threetwo meetings, in person, telephonically or by written consent with, all members attending each meeting.

Code of Ethics.

The Company has adopted a Code of Ethics that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the Code of Ethics is posted on the Santa Fe page of its parent company’sthe InterGroup website at www.intgla.com. The Company will provide to any person without charge, upon request, a copy of its Code of Ethics by sending such request to: Santa Fe Financial Corporation, Attn: Treasurer, 10940 Wilshire Blvd., Suite 2150, Los Angeles, CA 90024. The Company will promptly disclose any amendments or waivers to its Code of Ethics on Form 8-K and will post such information on its website.

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") requires the Company’s officers and directors, and each beneficial owner of more than ten percent of the Common Stock, of the Company, to file reports of ownership and changes in ownership with the Securities and Exchange Commission.SEC. Officers, directors and greater than ten-percent shareholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms received by the Company, or written representations from certain reporting persons that no Forms 5 were required for those persons, the Company believes that during fiscal 20132016 all filing requirements applicable to its officers, directors, and greater than ten-percent beneficial owners were complied with.

EXECUTIVE COMPENSATION

As a Smaller Reporting Company,smaller reporting company, Santa Fe has no compensation committee. Executive Officer compensation is set by independent members of the Board of Directors. The Board seeks to design and set compensation to attract and retain highly qualified executive officers and to align their interests with those of long-term owners of the Company. The Board has not engaged any compensation consultants in determining the amount or form of executive or director compensation, but does review and monitor published compensation surveys and studies. The Board may delegate to the Company’s Chief Executive Officer the authority determine the compensation of certain executive officers.

Santa Fe has no stock option plan or stock appreciation rights for its executive officers. The Company has no pension or long-term incentive plans. There are no employment contracts between Santa Fe and any executive officer, and there are no termination-of-employment or change-in-control arrangements.

The following table provides certain summary information concerning compensation awarded to, earned by, or paid to the Company’s principal executive officer and other named executive officers of the Company whose total compensation exceeded $100,000 for all services rendered to the Company for each of the Company’s last two competed fiscal years ended June 30, 20132016 and 2012.2015. No stock awards, long-term compensation, options or stock appreciation rights were granted to any of the named executive officers during the last two fiscal years.

SUMMARY COMPENSATION TABLE

| Annual Compensation | ||||||||||||||||||

| Name and Principal Position | Fiscal Year | Salary | Bonus | All Other Compensation | Total | |||||||||||||

| John V. Winfield | 2013 | $ | 267,000 | (1) | - | $ | 43,000 | (2) | $ | 310,000 | (1) | |||||||

| Chairman; President and Chief Executive Officer | 2012 | $ | 267,000 | (1) | - | $ | 43,000 | (2) | $ | 310,000 | (1) | |||||||

| Michael G. Zybala | 2013 | $ | 135,000 | $ | 18,000 | - | $ | 153,000 | (3) | |||||||||

| Vice President, Secretary and General Counsel | 2012 | $ | 126,000 | $ | 12,000 | - | $ | 138,000 | (3) | |||||||||

| David T. Nguyen | 2013 | $ | 90,000 | $ | 10,000 | $ | 100,000 | (4) | ||||||||||

| Treasurer and Controller (Principal Financial Officer) | 2012 | $ | 90,000 | $ | 10,000 | $ | 100,000 | (4) | ||||||||||

| Annual Compensation | |||||||||||||||||||

| Name and | Fiscal | All Other | |||||||||||||||||

| Principal Position | Year | Salary | Bonus | Compensation | Total | ||||||||||||||

| John V. Winfield | 2016 | $ | 392,000 | (1) | - | $ | 443,000 | (2)(4) | $ | 835,000 | (1) | ||||||||

| Chairman; President | 2015 | $ | 392,000 | (1) | - | $ | 43,000 | (2) | $ | 435,000 | (1) | ||||||||

| and Chief Executive Officer | |||||||||||||||||||

| David T. Nguyen | 2016 | $ | 120,000 | $ | - | $ | 120,000 | (3) | |||||||||||

| Treasurer and Controller | 2015 | $ | 118,000 | 12,000- | - | $ | 130,000 | (3) | |||||||||||

| (Principal Financial Officer) | |||||||||||||||||||

5

___________________

(1) Includes salary and director’s fees received from the Company’s subsidiary, Portsmouth, in the amountsamount of $134,000$272,000 for each of the fiscal years ended June 30, 20132016 and 20122015, respectively and directors fees in the amount of $6,000 per year paid by Santa Fe. Does not include compensation received from Santa Fe’s parent corporation, InterGroup, of $255,000$380,000 for each of the fiscal years ended June 30, 20132016 and June 30, 2012.2015, respectively.

(2)During fiscal years 20132016 and 2012,2015, the Company and Portsmouth also paid combined annual premiums of $43,000, for each respective year, for a split dollar whole life insurance policy,policies, owned by, and the beneficiary of which is, a trust for the benefit of Mr. Winfield’s family. Portsmouth’s share of those premiums was $17,000 per year. These policies were obtained in December 1998 and providesprovide for an aggregate death benefit of $2,500,000. The Company has a secured right to receive, from any proceeds of the policy, reimbursement of all premiums paid prior to any payments to the beneficiary.

(3)Includes salary and bonus paid by Portsmouth in the aggregate amount of $123,000$60,000 and $65,000 for fiscal yearyears ended June 30, 20132016 and salary of $113,000 for fiscal year ended June 30, 2012.2015, respectively. Does not include $47,000$120,000 and $55,000$132,000 paid by Santa Fe’s parent company, InterGroup, for fiscal years 20132016 and 2012,2015, respectively.

(4) In connection with the redemption of limited partnership interests of Justice in Note 2 of the consolidated financial statements, Justice agreed to pay a total of $1,550,000 in fees to certain officers and directors of the Company for services rendered in connection with the redemption of partnership interests, refinancing of Justice’s properties and reorganization of Justice Investors. The first payment under this agreement was made concurrently with the closing of the loan agreements, with the remaining payments due upon Justice having adequate available cash. In fiscal 2016, Mr. Winfield was paid $400,000.

(4) Includes salary

As a Smaller Reporting Company, Santa Fe has no compensation committee. Executive Officer compensation is set by disinterested members of the Board of Directors. Santa Fe has no stock option plan or stock appreciation rights for its executive officers. The Company has no pension or long-term incentive plans. There are no employment contracts between Santa Fe and bonus paid by Portsmouth in the aggregate amount of $50,000 for fiscal year ended June 30, 2013any executive officer, and salary in the amount of $50,000 for fiscal year ended June 30, 2012. Does not include $100,000 paid by Santa Fe’s parent company, InterGroup, for fiscal year 2013 and $100,000 for fiscal year 2012.

there are no termination-of-employment or change-in-control arrangements.

In fiscal year ended June 30, 2004, the disinterested members of the Boards of Directors of the Company and its subsidiary, Portsmouth, established a performance based compensation program for the Company’s CEO to keep and retain his services as a direct and active manager of the Company’s securities portfolio. Pursuant to the current criteria established by the Board, Mr. Winfield is entitled to performance based compensation for his management of the Company’s securities portfolio equal to 20% of all net investment gains generated in excess of an annual return equal to the Prime Rate of Interest (as published in the Wall Street Journal) plus 2%. Compensation amounts are calculated and paid quarterly based on the results of the Company’s investment portfolio for that quarter. Should the Company have a net investment loss during any quarter, Mr. Winfield would not be entitled to any further performance-based compensation until any such investment losses are recouped by the Company. This performance based compensation program may be further modified or terminated at the discretion of the respective Boards of Directors. The Company’s CEO did not earn any performance based compensation for the years ended June 30, 20132016 and 2012.2015.

Outstanding Equity Awards at Fiscal Year End

The Company did not have any outstanding equity awards at the end of its fiscal year ended June 30, 20132016 and has no equity compensation plans in effect.

Internal Revenue Code Limitations

Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), provides that, in the case of a publicly held corporation, the corporation is not generally allowed to deduct remuneration paid to its chief executive officer and certain other highly compensated officers to the extent that such remuneration exceeds $1,000,000 for the taxable year. Certain remuneration, however, is not subject to disallowance, including compensation paid on a commission basis and, if certain requirements prescribed by the Code are satisfied, other performance based compensation. For fiscal years 20132016 and 2012,2015, no compensation paid by the Company to its CEOMr. Winfield or other executive officers was subject the deduction disallowance prescribed by Section 162(m) of the Code.

6

SHAREHOLDER ADVISORY VOTES ON EXECUTIVE COMPENSATION

At its Fiscal 2010 Annual Meeting of Shareholders held on February 24, 2011, the Company submitted to its shareholders two proposals regarding executive compensation. The first proposal to approve, in a non-binding vote, the compensation of the Company’s named executive officers for fiscal year 2010 was approved by the shareholders, having received more than 99%98% of the shares voted at the meetingAnnual Meeting in favor of the proposal. The second proposal was to determine, in a non-binding vote, whether a shareholder advisory vote to approve the compensation of the Company’s executive officers should occur every one, two or three years. The shareholders overwhelmingly voted in favor of three years as the frequency in which the Company should have an advisory vote on executive compensation with more than 98%88% percent of the shares voted at the meetingAnnual Meeting being in favor of three years. The Compensation Committee and the Board of Directors have considered the guidance provided by thesethose advisory votes and have set three years as the frequency in which it will have a non-binding vote on executive compensation.

Accordingly, the Company submitted a proposal to approve, in a non-binding vote, the compensation of the Company’s named executive officers for fiscal year 2013, at its fiscal 2013 Annual Meeting of Shareholders held on February 20, 2014. That proposal was approved by the shareholders, having received more than 99% of the shares voted at the Annual Meeting in favor of the proposal. The Board of Directors considered the results of the advisory vote in reviewing our executive compensation program, noting the high level of shareholder support, and elected to continue the same principles and objectives in determining the types and amounts of compensation to be paid to our named executive officers in 2014. The Board of Directors will continue to focus on responsible executive compensation practices that attract, motivate and retain high performance executives, reward those executives for the achievement of long-term performance and support our other executive compensation objectives.

DIRECTOR COMPENSATION

The bylaws of Santa Fe permit directors to be paid a fixed sum for attendance at each meeting of the Board or a stated salary as director. Each director is paid a fee of $1,500 per quarter for a total annual compensation of $6,000. This policy has been in effect since July 1, 1985. Members of the Company’s Audit Committee also receive a fee of $500 per quarter. Directors and Committeecommittee members are also reimbursed for their out-of-pocket travel costs to attend meetings. The Board will review and may adjust Directordirector and Committee Compensationcommittee compensation from time to time to assure that the Company can continue to attract and retain qualified directors.

The following table provides information concerning compensation awarded to, earned by, or paid to the Company’s directors for the fiscal year ended June 30, 2013.2016.

DIRECTOR COMPENSATION TABLE

| Name | Fees Earned or Paid in Cash | All Other Compensation | Total | |||||||||

| John C. Love | $ | 46,000 | (1) | - | $ | 46,000 | ||||||

| William J. Nance | $ | 46,000 | (1) | - | $ | 46,000 | ||||||

| John V. Winfield(2) | - | - | - | |||||||||

__________________

| Name | Fees Earned | All Other Compensation | Total | |||||||||

| John C. Love | $ | 58,000(1) | $ | - | $ | 58,000 | ||||||

| William J. Nance | $ | 58,000(1) | $ | 200,000 | (3) | $ | 258,000 | |||||

| John V. Winfield(2) | $ | - | $ | - | $ | - | ||||||

(1) Mr. Love and Mr. Nance also serve as directors of the Company’s subsidiary, Portsmouth. Amounts shown include $8,000 in regular board and audit committee fees paid by Santa Fe and $8,000 in regular board and audit committee fees paid by Portsmouth. These amounts also include $30,000$42,000 in special hotelHotel committee fees paid to Mr. Love and Mr. Nance by Portsmouth related to the oversight of its Hotel asset. In June 2016, the Hotel Committee was terminated.

(2)As an executive officer, Mr. Winfield’s directors fees are reported in the Summary Compensation Table.

(3)In connection with the redemption of limited partnership interests of Justice in Note 2 of the consolidated financial statements, Justice agreed to pay a total of $1,550,000 in fees to certain officers and directors of the Company for services rendered in connection with the redemption of partnership interests, refinancing of Justice’s properties and reorganization of Justice Investors. The first payment under this agreement was made concurrently with the closing of the loan agreements, with the remaining payments due upon Justice having adequate available cash. In fiscal 2016, Mr. Nance was paid $200,000.

The bylaws of Santa Fe permit directors to be paid a fixed sum for attendance at each meeting of the Board or a stated retainer fee as director. Each director is paid a fee of $1,500 per quarter for a total annual compensation of $6,000. This policy has been in effect since July 1, 1985. Members of the Company’s Audit Committee also receive a fee of $500 per quarter.

Change in Control or Other Arrangements

Except for the foregoing, there are no other arrangements for compensation of directors and there are no employment contracts between the Company and its directors or any change in control arrangements.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

As of January 13, 2014,17, 2017, Santa Fe and InterGroup owned 81.8%82.2% of the common stock of Portsmouth, and InterGroup and John V. Winfield, in the aggregate, owned approximately 84.5%85.7% of the voting stock of Santa Fe. All of the Company’s Directorsdirectors serve as directors of InterGroup and all three of the Company’s Directorsdirectors serve on the Board of Portsmouth.

As of June 30, 2013, the Company has a note receivable from InterGroup in the amount of $644,000. The interest rate on the note is fixed at 4.85% and the note matures in December 2020.

In December 2013, the Compensation Committee of InterGroup approved an increase in the aggregate annual base compensation which Mr. Winfield receives from the Company, InterGroup and Portsmouth by a total of $250,000, of which it is anticipated that approximately $150,000 will be paid by InterGroup and approximately $100,000 will be paid by Portsmouth.

In connection with the successful completion of the refinancing of the San Francisco Hilton-Financial District owned by Justice Investors, a subsidiary of Portsmouth, and the reorganization of Justice, the Compensation Committee of InterGroup has approved payments to certain officers of Justice and the Company, including $500,000 to Mr. Winfield and $250,000 to Mr. Zybala. In addition, in connection with the foregoing, the Compensation Committee of InterGroup approved additional fees for service on Committees of the InterGroup and Portsmouth Boards of Directors as follows: $250,000 to each of Mr. Jacobs and Mr. Nance in connection with their service on the Strategic Options Committee of InterGroup; and $50,000 to Mr. Love in connection with his service on the Hotel Committee of Portsmouth. With respect to such fees (which will be paid by Justice), 20% was paid in December 2013, and it is anticipated that 20% will be paid in fiscal 2014 and the remaining 60% will be paid in fiscal 2015.

Certain costs and expenses, primarily administrative salaries, rent and insurance, are allocated among the Company, its subsidiary, Portsmouth, and parent company, InterGroup, based on management’s estimate of the pro rata utilization of resources. During each of the fiscal years ended June 30, 2013 and 2012, the Company and Portsmouth made payments to InterGroup of approximately $144,000 for administrative costs and reimbursement of direct and indirect costs associated with the management of the Companies and their investments, including the partnership asset.

As Chairman of the Securities Investment Committee, the Company’s President and Chief Executive officer, John V.Mr. Winfield, directs the investment activity of the Company in public and private markets pursuant to authority granted by the Board of Directors. Mr. Winfield also serves as Chief Executive Officer and Chairman of Portsmouth and InterGroup and oversees the investment activity of those companies. Depending on certain market conditions and various risk factors, the Chief Executive Officer, his family,Mr. Winfield, Portsmouth and InterGroup may, at times, invest in the same companies in which the Company invests. The Company encourages such investments because it places personal resources of the Chief Executive Officer and his family members,Mr. Winfield and the resources of Portsmouth and InterGroup, at risk in connection with investment decisions made on behalf of the Company.

In December 1998, Board of Directors authorized the Company to obtain whole life insurance and split dollar insurance policies covering the Company’s President and Chief Executive Officer, Mr. Winfield. During fiscal years 20122016 and 2011,2015, the Company paid annual premiums of $25,500$26,000 for the split dollar whole life insurance policy, owned by, and the beneficiary of which is, a trust for the benefit of Mr. Winfield’s family. The Company has a secured right to receive, from any proceeds of the policy, reimbursement of all premiums paid prior to any payments to the beneficiary. During fiscal 20122016 and 2011,2015, Portsmouth paid annual premiums of $17,000 for a split dollar policy also covering Mr. Winfield. The premiums associated with that spilt dollar policy are considered additional compensation to Mr. Winfield.

There are no other relationships or related transactions between the Company and any of its officers, directors, five-percent security holders or their families which require disclosure.

Director Independence

Santa Fe is an unlisted company and a Smaller Reporting Companysmaller reporting company under the rules and regulations of the Securities and Exchange Commission (“SEC”).SEC. With the exception of the Company’s President and CEO, John V.Mr. Winfield, all of Santa Fe’s Board of Directors consists of “independent” directors as independence is defined by the applicable rules and regulations of the SEC.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF JOHN V. WINFIELD, JOHN C. LOVE AND

WILLIAM J. NANCE AS DIRECTORS OF THE COMPANY.

PRINCIPAL HOLDERSSECURITY OWNERSHIP OF EQUITY SECURITIESCERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows,sets forth, as of January 13, 2014,2017, certain information with respect to the beneficial ownership of Common Stock of the Company owned by every person owning(i) each director and each of record (other than securities depositories),the named executive officers, (ii) all directors and executive officers as a group and (iii) those persons or groups known by the Company to own beneficially, more than 5%five percent of itsthe outstanding common shares. Any voting securities owned by directors orshares of Common Stock. Unless otherwise indicated, the business address for each director nominees are also disclosed under Election of Directors herein.and named executive officer is: 10940 Wilshire Blvd., Suite 2150, Los Angeles, CA 90024.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) |

Percent of Class(1) | ||||||

| The InterGroup Corporation 10940 Wilshire Blvd., Suite 2150 Los Angeles, CA 90024 | 1,000,227 | 80.5 | % | |||||

| John V Winfield 10940 Wilshire Blvd., Suite 2150 Los Angeles, CA 90024 | 49,400 | 4.0 | % | |||||

| The InterGroup Corporation and John V. Winfield as a group | 1,049,627 | (3) | 84.5 | % | ||||

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial |

| ||||||

The InterGroup Corporation 10940 Wilshire Blvd., Suite 2150 Los Angeles, CA 90024 | 1,015,170 | 81.7 | % | |||||

John V Winfield 10940 Wilshire Blvd., Suite 2150 Los Angeles, CA 90024

| 49,400 | 4.0 | % | |||||

The InterGroup Corporation and John V. Winfield as a group | 1,064,570 | (3) | 85.7 | % | ||||

_________________

(1) Unless otherwise indicated, and subject to applicable community property laws, each person has sole voting and investment power with respect to the shares beneficially owned.

(2) Percentages are calculated on the basis of 1,241,810 shares of Common Stock issued and outstanding as of January 13, 20144, 2016 plus any securities that the person has a right to acquire within 60 days pursuant to options, warrants, conversion privileges or other rights.

(3) Pursuant to a Voting Trust Agreement dated June 30, 1998, InterGroup has the power to vote the 49,400 shares of Common Stock owned by Mr. Winfield. As President, Chairman of the Board and a 62.8%62.9% beneficial shareholder of InterGroup, Mr. Winfield has voting and dispositive power over the shares owned of record and beneficially by InterGroup.

As of January 13, 2014, there were 1,241,810 shares of the Company's Common Stock outstanding, which were held by approximately 220 shareholders of record, with a total of approximately 420 shareholders, including beneficial owners.

PROPOSAL NO. 2

Ratification of the Appointment of

Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has appointed the firm of Burr Pilger Mayer, Inc. (“BPM” formerly, Burr, PilgerHein & Mayer LLP)Associates LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2014. BPM has served as the Company’s independent registered public accounting firm since October 23, 2007.2017. Although the action of shareholders in this matter is not required, the Audit Committee believes it is appropriate to seek shareholder ratification of this appointment. Ratification requires the affirmative vote of a majority of the shares represented and voted at the Annual Meeting.

We expect that a representative of BPMHein & Associates LLP will be present at the Annual Meeting to respond to appropriate questions from Shareholders,shareholders, and we will provide this representative with an opportunity to make a statement if he or she desires to do so.

THE FOLLOWING REPORT OF THE AUDIT COMMITTEE SHALL NOT BE DEEMED TO BE SOLICITING MATERIAL OR TO BE FILED WITH THE SEC UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934 OR INCORPORATED BY REFERENCE IN ANY DOCUMENT SO FILED.

AUDIT COMMITTEE REPORT

The Audit Committee’s responsibilities are described in a written charter adopted by the Board of Directors. The Audit Committee primary duties and responsibilities are to: serve as an independent and objective party to monitor the Company’s financial reporting process and internal control system; appoint and approve the compensation of the Company’s independent registered public accounting firm; review and appraise the audit efforts of the Company’s independent registered public accounting firm; and provide an open avenue of communications among the independent registered public accounting firm, financial and senior management, and the Board of Directors. During fiscal year ended June 30, 2013,2016, the Company retained Burr Pilger Mayer, Inc., formerly, Burr, Pilger & Mayer LLP (“BPM”) as its independent registered public accounting firm to provide audit and audit related services. All fees and expenses paid to BPM were approved by the Audit Committee.

The Audit Committee reviewed and discussed the audited financial statements with management and BPM, and management represented to the Audit Committee that the consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States. The discussions with BPM also included the matters required by Statement on Auditing Standards No. 114 (AICPA,Professional Standards, Vol. 1, AU Section 380), as adopted by the U.S. Public Company Accounting Oversight Board (United States)("PCAOB") in Rule 3200T regarding “Communication with Audit Committees.”

The Audit Committee has also received the written disclosures and the letter from BPM required by applicable requirements of the Public Company Accounting Oversight BoardPCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence, which was also discussed with BPM.

Based on the Audit Committee’s review of the audited financial statements, and the review and discussions with management and BPM referred to above, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 20132016 for filing with the Securities and Exchange Commission.

THE AUDIT COMMITTEE:

WILLIAM J. NANCE, CHAIRPERSON

JOHN C. LOVE

Audit Fees

The aggregate fees billed for each of the last two fiscal years ended June 30, 20132016 and 20122015 for professional services rendered by Burr Pilger Mayer, Inc.,BPM, the independent registered public accounting firm for the audit of the Company and its consolidated subsidiary’s annual financial statements and review of financial statements included in the Company’s Form 10-Q reports or services normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years, were as follows:

| Fiscal Year | Fiscal Year | |||||||||||||||

| 2013 | 2012 | 2016 | 2015 | |||||||||||||

| Audit fees | $ | 151,000 | $ | 156,000 | $ | 173,000 | $ | 173,000 | ||||||||

| Audit related fees | - | - | - | - | ||||||||||||

| Tax fees | - | - | - | - | ||||||||||||

| All other fees | - | - | - | - | ||||||||||||

| TOTAL: | $ | 151,000 | $ | 156,000 | $ | 173,000 | $ | 173,000 | ||||||||

Audit Committee Pre-Approval Policies

The Audit Committee shall pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by its independent registered public accounting firm, subject to any de minimus exceptions that may be set for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act which are approved by the Audit Committee prior to the completion of the audit. The Audit Committee may form and delegate authority to subcommittees consisting of one or more members when appropriate, including the authority to grant pre-approvals of audit and permitted non-audit services, provided that decisions of such subcommittee to grant pre-approvals shall be presented to the full Audit Committee at its next scheduled meeting. All of the services described herein were approved by the Audit Committee pursuant to its pre-approval policies.

None of the hours expended on the independent registered public accounting firms’ engagement to audit the Company’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the independent registered public accounting firm’s full-time permanent employees.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF BURR PILGER MAYER, INC.HEIN AND ASSOCIATES LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTANING FIRM.

11

PROPOSAL NO. 3

NON-BINDING VOTE ONPROPOSAL TO APPROVE THE COMPENSATION OF OUR EXECUTIVE COMPENSATIONOFFICERS

In accordance withSEC rules adopted pursuant to the requirements of Section 14A of the Exchange Act of 1934, which was added by therecently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd Frank Act”) andof 2010, or the related rules of the SEC, we are including in these proxy materials a separate resolution subjectDodd-Frank Act, enable our shareholders to shareholder vote to approve, in a non-binding vote,on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed on pages 5in this Proxy Statement in accordance with the SEC’s rules.

For the reasons stated below, we are requesting your approval of the following non-binding resolution:

“RESOLVED, that the compensation paid to 6. This votethe Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion is not intended to address any specific item of compensation, but rather the overallhereby APPROVED.”

The compensation of our named executive officers. The text ofofficers and our compensation philosophy policies are comprehensively described in the resolutiontables (including all footnotes) and narrative disclosure included in respect of Proposal No. 4 is as follows:this proxy statement.

“Resolved, that the shareholders approve, in a non-binding vote, theThe Board of Directors designs our compensation of the Company'spolicies for our named executive officers as disclosed on Pages 5 to 6 in the Proxy Statement relatingcreate executive compensation arrangements that are linked both to the Company's Fiscal 2013 Annual Meetingcreation of long-term growth, sustained shareholder value and individual and corporate performance, and are competitive with peer companies of similar size, value and complexity and encourage stock ownership by our senior management. Based on its review of the total compensation of our named executive officers for fiscal year 2016, the Board of Directors believes that the total compensation for each of the named executive officers is reasonable and effectively achieves the designed objectives of driving superior business and financial performance, attracting, retaining and motivating our people, aligning our executives with shareholders’ long-term interests, focusing on the long-term and creating balanced program elements that discourage excessive risk taking.

Neither the approval nor the disapproval of this resolution will be binding on us or the Board of Directors or will be construed as overruling a decision by us or the Board of Directors. Neither the approval nor the disapproval of this resolution will create or imply any change to be held on February 20, 2014.”our fiduciary duties or create or imply any additional fiduciary duties for us or the Board of Directors. However, the Board of Directors values the opinions that our shareholders express in their votes and will consider the outcome of the vote when making future executive compensation decisions as it deems appropriate.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOUSHAREHOLDERS VOTE “FOR”

TO APPROVE THE APPROVAL OFNON-BINDING ADVISORY RESOLUTION APPROVING THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

12

PROPOSAL NO. 4

NON-BINDING PROPOSAL REGARDING THE FREQUENCY (ONE, TWO OR THREE YEARS) WITH WHICH THE NON-BINDING SHAREHOLDER VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS SHOULD BE CONDUCTED

SEC rules adopted pursuant to the Dodd-Frank Act require that, not less frequently than once every three years, we will include in the proxy materials for a meeting of shareholders where executive compensation disclosure is required by the SEC rules, an advisory resolution subject to a non-binding shareholder vote to approve the compensation of our named executive officers. The approval of this resolution is included as Proposal 3 in this proxy statement. The Dodd-Frank Act also requires that, not less frequently than once every six years, we enable our shareholders to vote to approve, on an advisory (non-binding) basis, the frequency (one, two or three years) with which the non-binding shareholder vote to approve the compensation of our named executive officers should be conducted. In accordance with such rules, we are requesting your vote to advise us of whether you believe this non-binding shareholder vote to approve the compensation of our named executive officers should occur every one, two or three years, or abstain.

We believe that a non-binding shareholder vote on executive compensation should occur every three years. Our executive compensation program is designed to create executive compensation arrangements that are linked both to the creation of long-term growth, sustained shareholder value and individual and corporate performance, and are competitive with peer companies of similar size, value and complexity and encourage stock ownership by our senior management. One of the core principles of our executive compensation program is to ensure management’s interests are aligned with shareholders’ long-term interests, focusing on the long-term and creating balanced program elements that discourage excessive risk taking. Thus, we grant compensation focused on long-term performance. Accordingly, we recommend a triennial vote which would allow our executive compensation programs to be evaluated over a similar time-frame and in relation to our long-term performance.

A triennial vote will provide us with the time to thoughtfully respond to shareholders’ sentiments and implement any necessary changes. We carefully review changes to the program to maintain the consistency and credibility of the program which is important in motivating and retaining our employees. We therefore believe that a triennial vote is an appropriate frequency to provide our people and our Board of Directors sufficient time to thoughtfully consider shareholders’ input and to implement any appropriate changes to our executive compensation program, in light of the timing that would be appropriate to implement any decisions related to such changes.

We will continue to engage with our shareholders regarding our executive compensation program during the period between shareholder votes. Engagement with our shareholders is a key component of our corporate governance. We seek and are open to input from our shareholders regarding board and governance matters, as well as our executive compensation program, and believe we have been appropriately responsive to our shareholders. We believe this outreach to shareholders, and our shareholders’ ability to contact us at any time to express specific views on executive compensation, hold us accountable to shareholders and reduce the need for and value of more frequent advisory votes on executive compensation.

For the reasons stated above, the Board of Directors is recommending a voteFOR a three-year frequency for the non-binding shareholder vote to approve the compensation of our named executive officers. Note that shareholders are not voting to approve or disapprove the recommendation of the Board with respect to this proposal. Instead, each proxy card provides for four choices with respect to this proposal: a one, two or three year frequency, or shareholders may abstain from voting on the proposal and you are being asked only to express your preference for a one, two or three year frequency or to abstain from voting.

Your vote on this proposal will be non-binding on us and the Board of Directors and will not be construed as overruling a decision by us or the Board of Directors. Your vote will not create or imply any change to our fiduciary duties or create or imply any additional fiduciary duties for us or the Board of Directors. However, the Board of Directors values the opinions that our shareholders express in their votes and will consider the outcome of the vote when making such future compensation decisions as it deems appropriate.

13

OTHER BUSINESS

As of the date of this proxy statement, management knows of no business to be presented at the meetingAnnual Meeting that is not referred to in the accompanying notice. As to other business that may properly come before the meeting,Annual Meeting, it is intended that the proxies properly executed and returned will be voted in respect thereof at the discretion of the person voting the proxies in accordance with the best judgment of the person voting the proxies.

SHAREHOLDER PROPOSALS

It is presently anticipated that the fiscal 20142017 Annual Meeting of Shareholders will be held on February 26, 2015.March 2, 2018. Any shareholder proposals intended to be considered for inclusion in the proxy statement and form of proxy card for presentation at the fiscal 20142017 Annual Meeting of Shareholders must be received by the Company no later than September 26, 2014.the one year anniversary of the date that this proxy statement is mailed. In addition, all proposals must comply with the provisions of Rule 14a-8 adopted under Section 14(a) of the Securities Exchange act, as amended (the “Exchange Act”),Act, which lists the requirements for inclusion of shareholder proposals in company-sponsored proxy materials. Any proposals must be submitted in writing to the following address: Michael G. Zybala, Secretary,David Nguyen, Treasurer, Santa Financial Corporation, 10940 Wilshire Blvd., Suite 2150, Los Angeles, CA 90024. It is suggested that the proposal be submitted by certified mail – return receipt requested.

ANNUAL REPORT ON FORM 10-K

The Annual Report on Form 10-K for the fiscal year ended June 30, 20132016 accompanies this proxy statement, but is not deemed a part of the proxy solicitation material.materials. A copy of the Company’s Form 10-K for the fiscal year ended June 30, 2013,2016, as required to be filed with the Securities and Exchange Commission,SEC, excluding exhibits, will be mailed to shareholders without charge upon written request to: Michael G. Zybala, Secretary,John V. Winfield, President, Santa Fe Financial Corporation, 10940 Wilshire Blvd., Suite 2150, Los Angeles, CA 90024. Such request must set forth a good-faith representation that the requesting party was either a holder of record or a beneficial owner of the common stock of the CompanyCommon Stock on January 13, 2014.2017. The Company’s Form 10-K and other reports are also available on the Santa Fe page of its parent company’sthe InterGroup website at www.intgla.com and through the Securities and Exchange Commission’sSEC’s website www.sec.gov.

| By Order of the Board of Directors | |

| SANTA FE FINANCIAL CORPORATION | |

| Dated: Los Angeles, California | |

| January 27, 2017 | Clyde W. Tinnen |

| Acting Secretary |

Dated: Los Angeles, California

January 27, 2014